2020 Environmental Exposures and Coverage Solutions—A Carrier’s Perspective

Over the years, there have been several emerging trends that have gained the attention of the environmental liability insurance industry, including an increased awareness and focus on environmental regulations as well as the continued discovery of newly emerging contaminants, both regulated and unregulated.

As a result, environmental insurance has become more of a priority for many insureds involved in mergers and acquisitions transactions, brownfield development and general construction projects among others. As the market for environmental insurance continues to mature and expand, associated environmental liability issues have increased and a growing book of environmental claims has developed. Understanding and managing the risks and exposures involved with these environmental claims needs to be a key focus for any successful risk management strategy to succeed.

Environmental issues have been “emerging” for over 30 years as technology and regulatory developments have competed to keep pace with each other. Many environmental regulations on the books today are a result of one or more “major” environmental catastrophes or issues. We continue to see emerging issues develop which have a potential to influence an insureds’ liability. Issues can be classified as new classes of contaminants that may not have been previously detected or regulated, or older environmental exposures that are “re-emerging” due to new toxicological studies or re-interpretation of how chemicals and other contaminants behave in the subsurface.

The following examples provide insight on industry trends and issues that have emerged from exotic contaminants including some of the new EPA initiatives and the direct changes being implemented by the current administration and new state requirements.

Financial Assurance:

Industry Trend

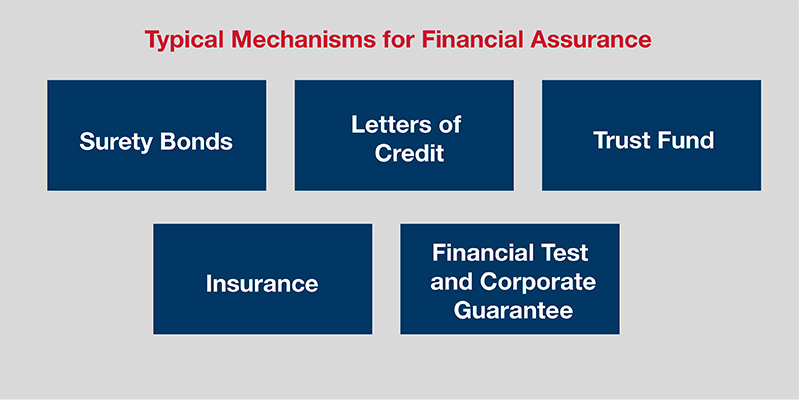

Financial assurance is proof of financial security (cash and non-cash) to guarantee the responsible party can cover the cost of complying with environmental objectives.

Those working with the Department of Toxic Substances Control (DTSC) are required by statute and regulation to provide adequate financial resources to pay for the long-term operation of certain types of cleanup systems. DTSC requires financial assurance for projects where a long-term cleanup system is essential to maintain environmental and human safety. Having a financial assurance mechanism in place ensures that DTSC can take over the management and stewardship of a cleanup in case the operator fails to meet its obligation due to financial insolvency or other reasons.

Financial Assurance requirements are found in the following environmental space

- Landfills - solid and hazardous wastes, closed or active

- Hazardous waste handling facilities

- Closure

- Post-Closure

Tips When Considering Coverage

- Not all states accept insurance as an FA mechanism

- Can be written on an admitted or non-admitted basis depending on the state regulations

- Financial review is just as important as the environmental data review

- Most often written on annual policy terms

- It’s important to consider not only the product but also when and who can offer coverage

Did you know? Not all insurance carriers are eligible to write non-admitted Financial Assurance policies in certain states

- Make sure to check your State's insurance department regulations

- Insurance carrier must be able to comply with and provide certification of the Financial Assurance

Per- and Polyfluoroalkyl Substance (PFAS):

Industry Trend

Per- and Polyfluoroalkyl Substance (PFAS) represent a class of chemicals containing thousands of unique formulation, which are combined to make a variety of products. Over the years, exposure to this chemical group has been linked to developmental issues in children, thyroid problems, certain cancers and other ill health effects.

What is PFAS?

- A family of chemicals used in firefighting foam, non-stick coatings, cleaning products, textiles, food packaging, carpeting and other consumer products

- Exposure has been linked to developmental issues in children, thyroid problems, certain cancers, and other ill health effects.

- They don't break down readily in water and can accumulate in the body.

Where is PFAS found?

Currently, the USEPA and numerous states have enacted either regulatory clean-up requirements or guidance on this fast-moving environmental concern. Regulatory guidance reflects early efforts to pull these compounds from the market and begin the process of cleaning up releases to the environment as well as broadly monitoring the chemical class as a whole.

Tips When Considering Coverage

Continued awareness of proposed regulations and state and federal initiatives may allow carriers and their insureds to respond and appropriately manage the risk, potential occurrence and severity of claims.

Underwriting will include a review of current environmental reports on sites to determine potential PFAS usage.

- Any sites with an operational history indicative of potential PFAS use receive extra scrutiny

- If site has been investigated and is clean or has no history of PFAS usage –coverage restrictions related to PFAS are unlikely

- If site has been investigated and has confirmed PFAS or history suggestive of PFAS but no investigation – coverage restrictions likely will apply

Did you know? PFAS Standards are RisingTougher PFAS standards could force U.S. drinking water suppliers to spend billions of dollars to remove the chemicals from water supplies. It could also require users (past and present) of PFAS chemicals to pay for environmental remediation and potentially personal injury damages.

- Could require users (past and present) of PFAS chemicals to pay for environmental remediation and potentially personal injury damages.

Redevelopment Coverage:

Industry Trend

Today, redevelopment risks continue to dominate the insurance submission flow with the economy, availability and ease of access to money driving this trend.

Underwriting Benefits and Challenges

Some of the benefits of environmentally mature redevelopment sites include:

- More significant environmental history (industrial, manufacturing, etc.)

- Significant regulatory oversight

- Relevant and recent environmental reports

On the other hand, challenges of smaller redevelopment sites include:

- Lack of sufficient information for underwriting exposures (to be encountered during soil excavation)

- No information is present, but the insured has been told that certain coverages are commonplace

“Just because it wasn’t sampled for, doesn’t mean it’s not there”

Phase II Reports often evaluate whether or not a site slated for redevelopment has been impacted by the identified RECs (Recognized Environmental Condition). In many instances, these reports fail to adequately address the potential exposures associated with disposal of soil or fill material as it relates to the acceptance of that material at various disposal facilities.

Tips When Considering Coverage

The market has changed – development costs are now expected to be picked up by the insured, not supplemented by the carrier. While it’s rare to get information needed upfront, carriers understand that it is likely going to be part of the development process later on. If new information becomes available, underwriting approaches for redevelopment sites can be amended mid-term.

"Amazon Effect":

Industry Trend

With e-commerce increasingly becoming the preferred method for retail shopping, many retail properties are being renovated and re-purposed to alternative uses to maximize returns, such as residential, hospitality or entertainment. Often, many of these renovations will expand or alter their current footprint to meet the proposed future uses, which may result in unforeseen environmental exposures.

“Amazon Effect” Exposure

- Unanticipated development exposures

- Re-opener exposures due to change in uses from commercial to residential

- Mold encountered during renovations

- Bigger exposure on longer term policies

Tips When Considering Coverage

- Evaluate tenant leases (time remaining), and review financials or rent rolls

- Familiarity with surrounding developments, change in neighborhood which may support continued retail needs.

- Tailor material change in-use exclusions to address future alterations with option to re-evaluate planned change in use (to then offer the ability to expand coverage at that time.)

An opportunity we do see arising is an increase in warehousing and logistics center submissions and associated truck terminals in support of this e-commerce business.

Conclusion:

There is no silver bullet for emerging environmental issues when it comes to obtaining coverage or responding to a claim. The landscape for new contaminants can change quickly. Standards are being promulgated on an almost daily basis and the emerging issues are being “tested” in case law as well.

It is important to trust in a carrier who carefully evaluates the impact new environmental regulations and emerging contaminants may have on certain operations. Great American Environmental continues to monitor proposed regulations and state and federal initiatives, allowing us to respond and appropriately manage the risk, potential occurrence and severity of claims.

Kent Pollaro, Senior Production Underwriting Manager

Great American Environmental Division

Patrick Mahoney, Divisional Vice President and Executive Underwriter

Great American Environmental Division

Patrick is a Divisional Vice President and Executive Underwriter for Great American’s Environmental Division. In his role, Patrick works directly with the Chief Underwriting Officer to oversee and develop the division's comprehensive portfolio of customized products. In addition to managing the division’s strong underwriting discipline and fostering an industry-leading collaborative work environment, Patrick acts as a referral resource to the national and executive underwriting teams as well as serves as a lead underwriter for the division’s specialty products. Patrick has accumulated nearly 20 years working in the insurance field and has been with Great American’s Environmental Division since 2008. He is based out of the Exton, Pennsylvania office.