Strength Through Catastrophe in the Early 20th Century

For 150 years, Great American Insurance has grown and prospered with each generation. With the help of its people and sound financial management, the company has weathered many of the great challenges of the 20th Century, maintaining an “A” or better rating by AM Best since beginning ratings in 1908.

It was this month in 1906, when the insurance industry was faced with a major crisis. On April 18, San Francisco was shaken by a massive earthquake.

The earthquake severely compromised the city water system and broke gas mains. Both escaping gas and short-circuited electric wires caused fires to spread widely. Because of the lack of water, the fire department was helpless to contain the fire, which burned for three days. More than 3,000 people died and 80% of San Francisco was destroyed. The property loss was approximately $350 million. The National Board estimated at the time that the loss was greater than the aggregate of all the major fires in the United States in the 50 years prior.

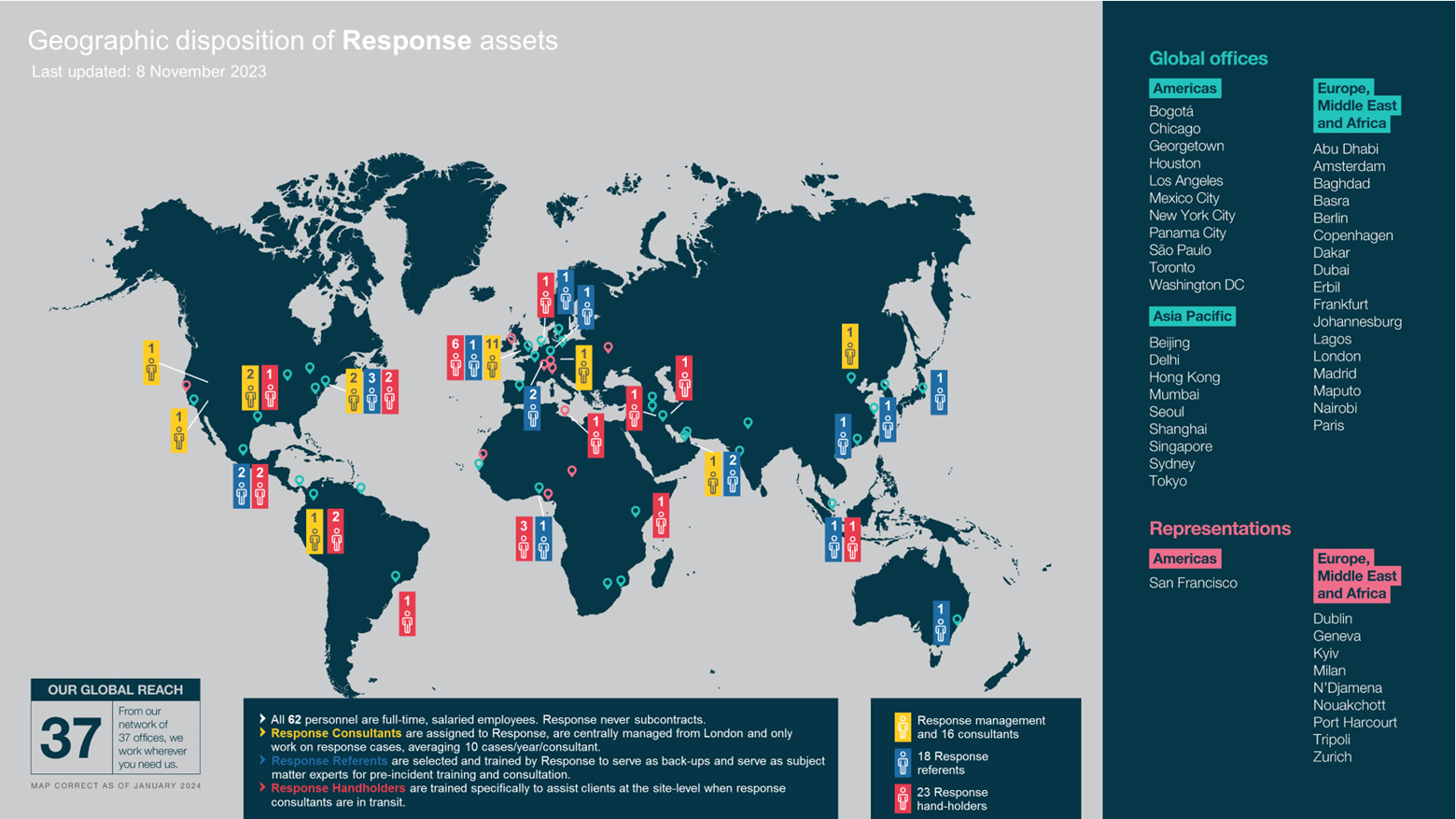

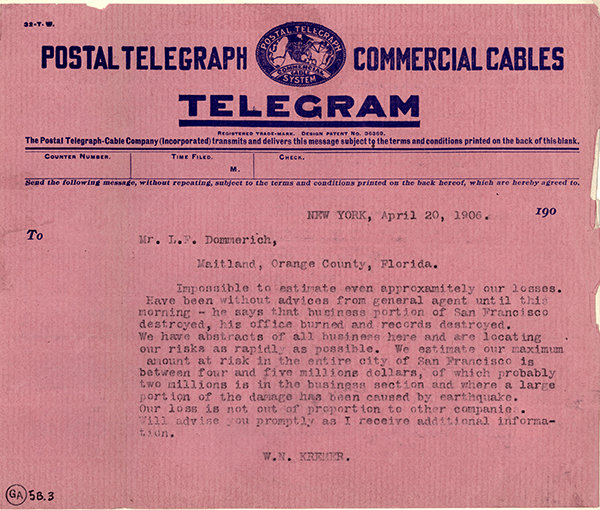

Our predecessor company, German American received word of the damage in San Francisco as early as April 19. The telegram below from April 20 shows how agents communicated the level of damage. German American was in a fortunate position because the last set of weekly records had been forwarded to New York from the San Francisco office two days before the fire, so the company had a strong understanding of its exposure.

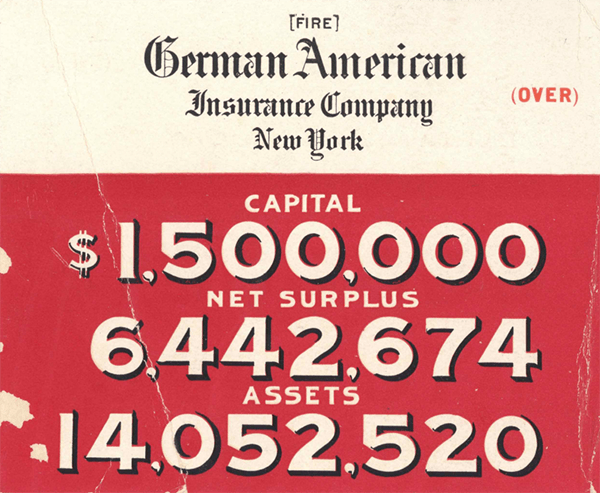

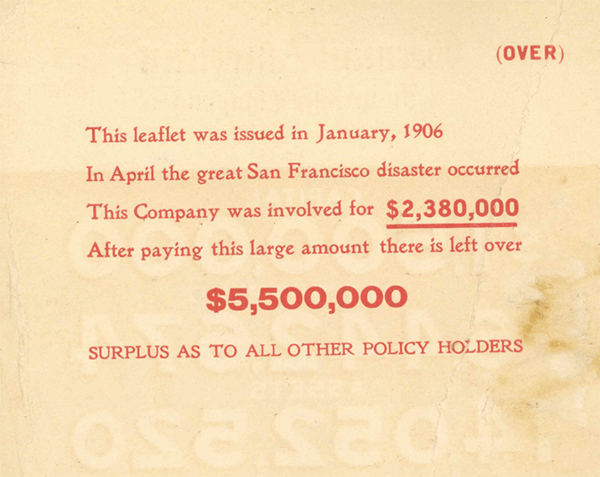

German American was among the top 35 carriers in the country who paid about half of the total loss. Many other companies collapsed or refused to pay their claims in full. In the end, German American paid out more than $2.3 million in claims.

Flier from 1906 amended with impact of San Francisco claims.

The first half of the 20th Century was marked by war and economic turmoil. Through these events, Great American remained strong.

World War I had a significant impact on the company. Anti-German sentiment motivated the name change from German American Insurance to Great American Insurance. In the company archive, we found an interesting recollection from an employee whose long tenure with the company stretched from 1908 to the 1950s. He described a particular challenge that employees endured during the war: “In an effort to conserve power during the war, there were many heatless days. We were allowed electricity, but no heat. The office would get so very cold that many of us wore heavy turtleneck sweaters to work. The oil in the adding machines would congeal on occasion and we were hard put to get the daily figures to Mr. Koop. Mr. Koop did not wear a turtleneck sweater but he never did miss a ‘heatless’ day.”

During the Great Depression, like many other insurance companies, Great American reduced its capital to bolster its surplus. This was a challenging period for the company. With numerous mercantile and industrial plants out of business, premiums decreased in the early 1930s.

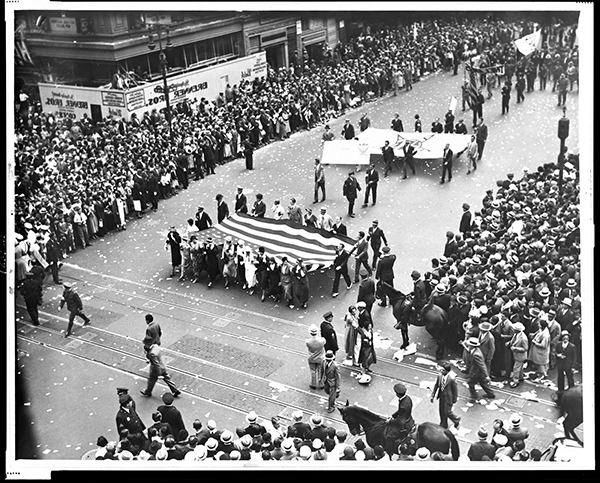

In 1933, the New Deal’s National Industrial Recovery Act (NIRA) passed. NIRA, administered by the National Recovery Administration (NRA), was intended to spread available work among a larger number of workers and promote fair wages. To support the NRA, parades were held in several U.S. cities. In New York, on September 13, a crowd of almost 250,000 people representing 77 industries marched for nearly 10 hours. A contingent of Great American employees participated, carrying a banner to identify the group. According to company records, it took the group more than six hours to get to the reviewing stand.

By the mid-1930s, premiums started to rebound. World events took front stage again in 1939 with the start of World War II. The demand for more coverage in the fire, marine, casualty, surety and compensation branches increased rapidly and the company worked to provide adequate protection. In May 1942, the company became an issuing agent for the sale of U.S. Defense Bonds. In the summer of that year, the company announced that all Great American fire companies would act as fiduciary agents for the purpose of issuing War Damage Corporation policies.

Great American was also an agent for the sale of War Risk Cargo insurance. The company had one year of adverse experiences in 1942 when enemy sinkings were responsible for losses equal to 106.8% of the more than $4 million of earned ocean marine premium income.

During the war, employees pulled together once again. To support the men and women serving overseas, employees collected money to donate an ambulance to the American Field Service.

According to company records, 375 employees left the company to enter the military or naval services during World War II and after the war, 135 returned for service in the organization.

Interested in seeing how Great American grew into the company it is today? Visit our Company Story to see why our yesterdays tell an important story about our tomorrow.

Most recent AM Best rating of “A+” (Superior) affirmed December 3, 2021.