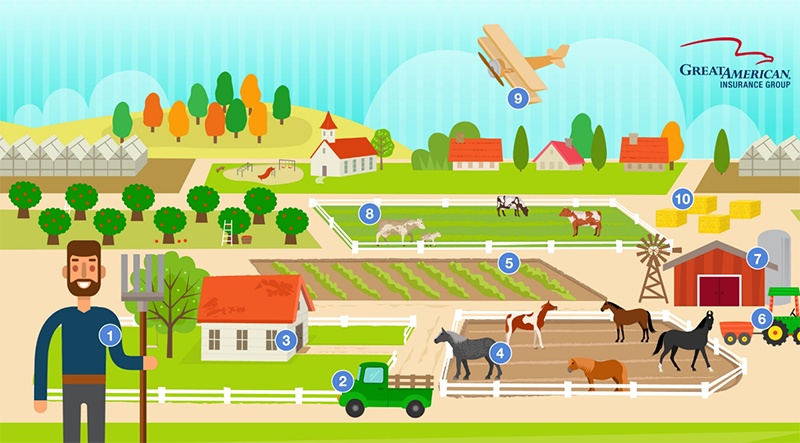

We Have it Covered - From the Farmer to the Fields

Farmers care for the crops and livestock in the fields that provide food and help drive our economy. In turn, Great American offers property and casualty coverages for farmers and their assets if something goes wrong and they experience a loss. See if you know the coverages we offer, ranging from the farmer to the fields.

- Farmers: We provide coverages that protect the farmer specifically. The AgriBusiness® Division provides personal liability and identify theft coverage for farmers who have personal exposures. Republic, Summit and Strategic Comp offer workers' compensation coverage for farmers and other individuals working on their farms.

- Commercial auto: The AgriBusiness® Division's Commercial Auto form offers coverage for the farmer's vehicle, from private passenger and pickup trucks all the way to tractor trailers.

- Dwellings: The AgriBusiness® Division offers coverages that protect the farmer's home on the farm. The division also covers tenant-occupied dwellings on the property where farm managers and other employees of the farm may live.

- Horses: Both the AgriBusiness® Division and Equine Mortality offer coverages for equine risks.

The AgriBusiness® Division provides Care, Custody and Control coverage for farms and ranches that have non-owned horses on their property. In addition, the division also offers policies for individual horse owners and race horse owners.

Equine Mortality provides medical and mortality coverage for horses.

- Crops: Both the Crop Division and the AgriBusiness® Division offer coverages for crop.

The Crop Division offers a range of coverages for the fruits, vegetables and other crops while they are growing. The top three products the division insures are corn, soybeans and wheat. Great American also offers a wide range of specialized coverages including citrus, raisin reconditioning and sugar beet replant. The division offers farmers protection against a reduction in yield due to unavoidable crop losses caused by acts of nature or disease, as well as revenue protection caused by commodity price fluctuations.

The AgriBusiness® Division offers coverages for crops once they are harvested.

- Equipment: The AgriBusiness® Division's Farm Property Coverage form covers farm equipment such as tractors, combines, harvesters and irrigation equipment. Property & Inland Marine also offers insurance solutions for this type of equipment under its Inland Marine coverages. Specialty Equipment Services provides lease and loan coverage for some forms of farm equipment.

- Barns: The AgriBusiness® Division offers coverages that protect barns and their contents.

- Dairy cows: The DairyPak® product from the AgriBusiness® Division offers comprehensive policies for dairy farmers that includes insuring cattle, their milk and milking facilities. The Crop Division also offers dairy coverages, which includes financial protection for farmers in the form of Livestock Gross Margin and Whole Farm Revenue Protection.

- Agricultural aircraft: The Aviation Division insures aircraft that provide aerial application of crop protection products for farms. Farmers will generally hire an aircraft operator to spray their fields for them. Some operators will just have one aircraft, while others may have a fleet of aircraft. Aviation provides hull and liability coverage for these aircraft.

- Hay: In addition to Multi-Peril coverage, the Crop Division's Named Peril Insurance offers specialized coverage that can protect against unforeseen losses, such as hay fire. Fire is one of the greatest risks for hay that is already stacked. In a matter of minutes, a hay fire can eliminate an entire year's worth of revenue.