Are You Appropriately Valuing Your Property?

By Mike Liguzinski, Divisional President, Specialty Human Services

Accurate property valuation is essential to your insurance policy. To confirm you’re correctly calculating its worth, make sure you’re using the appropriate tools. Double check your figures to avoid miscalculations that could sabotage your valuation.

To uncover possible miscalculations of current exposures in your property valuation estimate, pay special attention to common areas where error may occur:

- Use of the wrong valuation estimator tool, or making data entry errors when using the right tool. An incorrect zip code or construction type can lead to millions in underinsurance. Using replacement cost software tools can help the user avoid these errors. Your agent or carrier should assist you with this. Note: best practice is to get a formal replacement cost appraisal every three to five years.

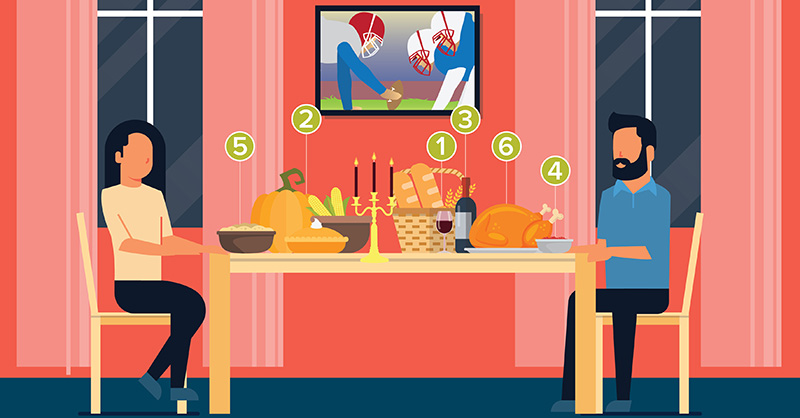

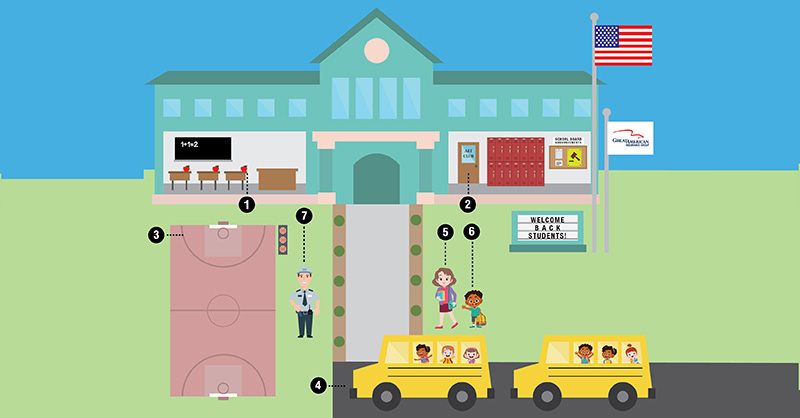

- Omitting items off your inventory checklist when totaling up the complete replacement cost amount – this may include all contents, sidewalks, improvements, outbuildings, foundations, security systems, fences, computers and more.

According to William K Austin, “Understanding the current value of a critical asset is of utmost importance whether it is a building or a particular segment of contents. Determining the correct value of an insured asset pre-loss will greatly improve coverage and increase the potential for an insurance settlement that truly puts the insured in the same position post-loss event that existed pre-loss event.”8

Are you ready to take control of your property insurance? Our 5 Steps to Taking Control can help you have a conversation with your agent.